- Accept card payments – lowest rates from 0.27%

- Keep your card processing fees to a minimum

- Direct access to the UK’s leading card processing banks

- We ensure your rates always remain competitive

No spam emails or calls

Choose from the payment methods then click Next

What's your turnover each month?

Enter the name of your company

Enter your company's postcode and contact number

Online Payments

The Best Online Payment Service Providers in 2025

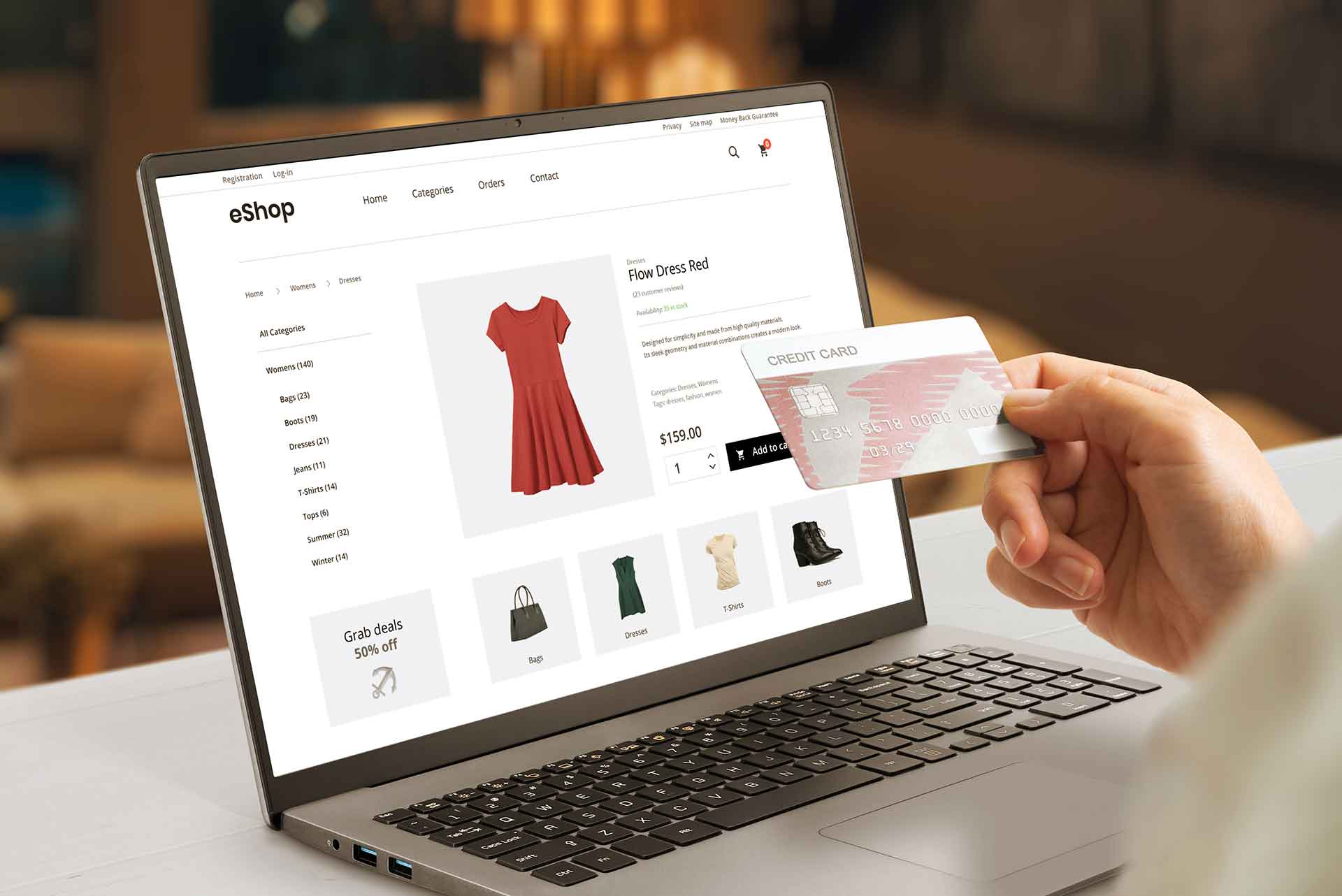

In the ever-evolving world of digital commerce, online payment providers have become the backbone of modern businesses. As we move further into the digital age, the demand for seamless, secure, and cost-effective online payment processing services continues to grow. For UK businesses, choosing the right payment solution is no longer just a convenience—it’s a necessity. Whether you’re a small business owner or part of a larger enterprise, the right online payment platform can transform your payment journey, boost cash flow, and enhance the customer experience.

In this guide, we’ll explore the best online payment service providers in 2025, highlighting their features, benefits, and how they can help your business start accepting payments with ease. From PayPal payments to alternative payment methods like Apple Pay, Google Pay, and Amazon Pay, we’ll cover everything you need to know to make an informed decision.

The Evolution of Online Payment Systems

The rise of digital transactions has revolutionized the way customers pay for goods and services. Gone are the days when businesses relied solely on in-person payments or traditional card payments. Today, online payment systems offer a wide range of options, from recurring payments to payment links, making it easier than ever for businesses to process payments efficiently.

One of the key drivers of this evolution is the increasing adoption of embedded payments and API integration, which allow businesses to integrate payment gateways directly into their ecommerce platforms or web hosting sites. This seamless integration not only improves the checkout flow but also helps reduce costs by eliminating the need for additional fees or hidden fees often associated with traditional payment processing.

Moreover, advancements in machine learning and data analytics have enabled payment processors to offer more secure online payments, reducing the risk of fraud and enhancing the overall customer experience. With open banking gaining traction, businesses can now access more cost-effective solutions that cater to their specific needs.

The Best Online Payment Service Providers 2025

What is a Payment Gateway?

Key Features to Look for in an Online Payment Provider

When choosing the best online payment method for your business, it’s essential to consider the following features:

- Secure Online Payments: Security is paramount in online transactions. Look for providers that offer robust encryption, fraud detection, and compliance with industry standards like PCI DSS.

- Transaction Fees: Payment processing fees can vary significantly between providers. Some charge a fixed fee per transaction, while others may have higher fees or monthly fees. Be sure to read the fine print to avoid unexpected costs.

- Payment Gateway Integration: A seamless payment gateway integration ensures that your checkout flow is smooth and hassle-free. Providers that offer client and server libraries or payment buttons can simplify the process, even for those with limited technical knowledge.

- Support for Alternative Payment Methods: In addition to traditional card payments, consider providers that support alternative payment methods like Apple Pay, Google Pay, Samsung Pay, and PayPal payments. This flexibility can help you cater to customers worldwide and improve conversion rates.

- Recurring Payments: If your business model relies on subscriptions or repeat customers, a provider that supports recurring payments is a must.

- Virtual Terminal and Card Readers: For businesses that also handle in-person payments, look for providers that offer virtual terminals or card readers to streamline your financial infrastructure.

- Scalability: As your business grows, your payment solution should be able to scale with you. Providers that cater to over one million merchants are often a safe bet.

Payment Gateway Costs and Fees

Understanding the costs and fees associated with payment gateways is essential for businesses looking to manage their expenses effectively. Payment gateway fees can vary widely depending on the provider and the specific services offered. Common fees include transaction fees, setup fees, monthly fees, and chargeback fees. Transaction fees are typically a combination of a percentage of the transaction amount plus a fixed fee per transaction. Setup fees may be charged for the initial setup and integration of the payment gateway, while monthly fees cover ongoing maintenance and support. Chargeback fees are incurred when a transaction is disputed by the customer. It’s crucial for businesses to carefully review the fee structure and terms of a payment gateway provider to avoid unexpected costs and ensure they are getting the best value for their investment.

The Top Online Payment Providers in 2025

Here are some of the best online payment service providers that are making waves in 2025:

1. PayPal

A household name in online payments, PayPal continues to dominate the market with its user-friendly platform and extensive features. From PayPal payments to payment links, PayPal offers a versatile payment solution for businesses of all sizes. With low setup fees and no hidden fees, it’s a cost-effective choice for UK businesses.

2. Stripe

Known for its robust API integration and support for embedded payments, Stripe is a favorite among tech-savvy businesses. It supports a wide range of payment methods, including Apple Pay, Google Pay, and Amazon Pay, making it ideal for businesses looking to cater to a global audience.

3. Square

Square is a great option for businesses that handle both online and in-person payments. With its virtual terminal and card readers, Square offers a seamless payment journey for customers. Its transparent payment processing fees and lack of monthly fees make it a popular choice for small businesses.

4. Sage Pay

Sage Pay is a trusted payment platform for UK businesses, offering secure online payment processing and a range of features like recurring payments and payment forms. Its competitive transaction fees and excellent customer support make it a reliable choice.

5. Adyen

Adyen is a global payment processor that supports over one million merchants. With its advanced data analytics and support for alternative payment methods, Adyen is perfect for businesses looking to optimize their payment systems and improve cash flow.

6. Worldpay

Worldpay offers a comprehensive online payment gateway with support for card payments, digital transactions, and more. Its flexible pricing structure and ability to reduce transaction fees make it a strong contender for businesses of all sizes.

First Data / Fiserv

First Data, now part of Fiserv, offers a wide array of payment processing solutions. They are recognized for their innovation and reliability, making them a preferred choice for businesses seeking advanced payment technologies.

AIB Merchant Services

AIB Merchant Services offers a wide range of payment solutions. They are known for their comprehensive and secure services, catering to businesses looking for versatile payment processing capabilities.

Paypoint

Paypoint helps over 28,000 businesses with payment solutions. They offer a range of services known for their convenience and reliability, suitable for businesses seeking accessible payment processing options.

IZettle

iZettle, now Zettle by PayPal, provides innovative mobile payment solutions. They are ideal for small businesses and entrepreneurs seeking user-friendly and portable payment options.

Fiserv

Fiserv, known for its comprehensive payments and business solutions, offers a range of advanced payment processing services. They are a top choice for businesses seeking integrated and scalable payment systems.

SecurionPay

SecurionPay offers facilities for efficient and secure online payments. Their services are designed for businesses seeking reliable and straightforward online payment processing.

Smarttrade App

Smarttrade is notable for its mobile app-based payment solutions. They cater to businesses looking for easy and mobile-friendly payment processing, ideal for on-the-go transactions.

Klarna

Klarna is recognized for its innovative payment solutions, including packaged banking services. They offer user-friendly and flexible payment options, appealing to businesses and consumers seeking modern payment methods.

First Data

First Data, now Fiserv, is known for its extensive range of payment processing solutions. They offer services that are both innovative and reliable, making them a top choice for businesses seeking advanced payment technologies.

Authorize.Net

As an American card payment gateway, Authorize.Net specializes in providing secure and user-friendly online payment solutions. Their services are ideal for businesses seeking reliable and integrated online transaction processing.

Zettle by Paypal

Zettle, now part of PayPal, offers mobile and efficient payment solutions. They are known for their user-friendly card readers and POS systems, catering to small businesses and entrepreneurs.

Opayo by Sage Pay and Elavon

Opayo, formerly Sage Pay, now part of Elavon, provides a range of secure and flexible payment solutions. They are a go-to provider for businesses seeking reliable and comprehensive payment services.

Barclays

Barclays offers facilities for managing and processing payments efficiently. Their services are designed for businesses looking for secure and comprehensive banking and payment solutions.

EVO Payments

Founded in 1989, EVO Payments is known for its global payment solutions. They offer a range of services focusing on security and innovation, catering to businesses seeking international payment processing capabilities.

Worldpay

Worldpay supports more than 400,000 merchants worldwide, providing a wide range of payment processing services. Their solutions are known for being versatile and reliable, suitable for businesses of various sizes and sectors.

Payzone

Payzone merchant services are designed for small and medium-sized businesses. They offer tailored payment solutions that are both secure and user-friendly, making them a preferred choice for growing businesses.

First Payment

Launched in 2011, First Payment provides a range of merchant services focused on efficiency and security. They are ideal for businesses looking for personalized and reliable payment solutions.

Verifone

Verifone offers facilities for taking payments through various methods. Their services are known for their security and versatility, catering to businesses seeking flexible and reliable payment processing.

Retail Merchant Services

Retail Merchant Services provides a range of payment solutions tailored for retail businesses. They focus on delivering secure and user-friendly services, ideal for retailers seeking efficient transaction processing.

Axcess Merchant Services

Axcess Merchant Services offers merchant accounts and payment processing solutions. They are known for their customized services, catering to businesses seeking tailored payment processing options.

Shopify

Known as a subscription-based software allowing anyone to set up an online store and sell their products, Shopify offers integrated payment solutions. They are ideal for e-commerce businesses seeking comprehensive and user-friendly online sales and payment systems.

Credorax

Credorax offers facilities for managing payments efficiently. Their services are tailored for businesses seeking advanced and secure payment processing solutions.

Handepay

Handepay provides payment processing solutions with a focus on simplicity and affordability. They cater to small and medium-sized businesses looking for straightforward and cost-effective payment systems.

Cybersource

Cybersource offers facilities for secure online payment processing. They are known for their comprehensive and reliable services, making them suitable for businesses that prioritize secure and efficient online transactions.

Global Payments

Global Payments stands out for its comprehensive and global payment solutions. They offer a wide range of services tailored to meet the diverse needs of businesses, emphasizing security and efficiency.

Natwest

Natwest provides fast, secure, and convenient payment services. Their focus on efficient and reliable transaction processing makes them a preferred choice for businesses looking for streamlined banking and payment solutions.

Global Iris

Global Iris, part of Global Payments, is renowned for its comprehensive payment solutions. They offer a range of services tailored for secure and efficient transaction processing, catering to businesses seeking robust payment systems.

Cardsave

Cardsave, known for offering facilities through card machines and an online payment gateway, specializes in diverse and user-friendly payment solutions. They cater to businesses looking for reliable and accessible card processing and online payment services.

NetPay

NetPay, recognized for offering facilities for taking payments through an online payment gateway, provides diverse and secure payment solutions. Prioritizing efficient and reliable transaction processing, NetPay caters to a wide range of clients. Their services,...

EPOS Now

EPOS Now, known for being a company specializing in EPOS equipment and software, offers tailored payment solutions. Emphasizing secure and adaptable transaction processing, EPOS Now serves various business needs. Their services, which include specialized EPOS...

Transax

Transax, known for its facilities for taking payments through phone payments, specializes in versatile payment solutions. Focusing on secure and user-friendly transaction processing, Transax is ideal for businesses needing phone payment options. Their services,...

Monek

Monek, recognized for its global payment platform that supports all payment types, offers comprehensive payment solutions. With a commitment to secure and all-encompassing transaction processing, Monek addresses the needs of a global clientele. Their services,...

Amazon Pay

Amazon Pay, known for offering facilities for taking payments through an online payment gateway, delivers tailored and secure payment solutions. Concentrating on reliable and streamlined transaction processing, Amazon Pay serves a broad spectrum of customers. Their...

First Payment Merchant Services

Known for their comprehensive merchant services, First Payment Merchant Services offers specialized solutions in payment processing. Their focus on secure and efficient transactions makes them a preferred choice for businesses seeking reliable merchant services.

HSBC Merchant Services

HSBC Merchant Services, recognized for their wide range of payment solutions, provides secure and diverse payment options. They cater to various business needs, emphasizing customer satisfaction and transaction reliability.

Braintree

Braintree, an online payments solution provider, offers a suite of payment processing tools. Their services are known for being user-friendly and robust, making them a top choice for businesses looking for advanced online payment solutions.

Bank Of Ireland Payment Acceptance

Known for their payment acceptance solutions, the Bank Of Ireland Payment Acceptance provides secure and versatile payment processing services. Their focus on customer-centric solutions makes them a reliable partner for businesses of all sizes.

Card Cutters

Card Cutters are recognized for their facilities in card machine and online payment gateway services. They offer tailored payment solutions that are both secure and easy to use, making them an attractive choice for businesses seeking comprehensive payment processing.

Paymentsense

Paymentsense, renowned for using the latest technology in payment processing, offers cutting-edge and reliable payment solutions. They cater to businesses of all sizes, providing efficient and secure transaction processing. Known for their innovation and...

SumUp

SumUp, known for offering the card reader that turns your smartphone or tablet into a complete mobile point of sale, provides versatile and accessible payment solutions. Focused on user-friendly and mobile-friendly transaction processing, SumUp is ideal for small...

Elavon

Elavon, recognized for their expertise in payment processing, offers a wide range of secure and efficient payment solutions. They are a preferred choice for businesses looking for comprehensive and reliable payment services with global reach.

SimplyPayMe

SimplyPayMe, known as the mobile app for small businesses, offers innovative and flexible payment solutions. They specialize in providing user-friendly and mobile-centric payment services, catering to the needs of on-the-go businesses and service providers.

Sage Pay (now Opayo)

Sage Pay, now known as Opayo, offers trusted and secure payment solutions. They are renowned for their reliability and comprehensive services, making them a top choice for businesses seeking advanced and versatile payment processing options.

Allied Wallet

Allied Wallet, known for offering flexible online payment processing solutions, provides a range of secure and user-friendly payment options. Their services are tailored to meet the diverse needs of online merchants and e-commerce businesses.

SmartDebit

SmartDebit, recognized for their facilities in managing direct debits, offers tailored payment processing solutions focused on efficiency and security. They are a go-to provider for businesses seeking reliable direct debit management services.

Cardstream

Cardstream, known for their online payment gateway services, provides comprehensive and secure online payment solutions. Their focus on customizable and integrated payment systems makes them a preferred choice for businesses looking to enhance their online payment...

Stripe

Stripe, celebrated for bringing together everything required to build websites and apps that accept payments globally, offers a full suite of advanced payment solutions. They are renowned for their innovative and developer-friendly approach, making them ideal for...

Paysafe

Paysafe, a global leader in payments, offers a wide array of tailored and secure payment solutions. Their focus on adaptable and comprehensive services caters to businesses seeking scalable and global payment processing options.